Clause 2.4: Employer’s Financial Arrangements is a critical component in the FIDIC Yellow Book 2017, ensuring financial transparency and security in construction contracts. This clause outlines the obligations of the Employer regarding their financial arrangements to meet contract commitments.

Key Aspects of Clause 2.4

- Financial Arrangements in Contract Data: The Employer’s financial plans for fulfilling contract obligations must be detailed in the Contract Data.

- Notification of Material Change:

- Obligation to Inform: If the Employer plans to significantly change their financial arrangements, or if changes occur due to their financial situation, they must immediately notify the Contractor with detailed particulars.

- Impact Assessment: The change should be such that it affects the Employer’s ability to pay the remaining Contract Price, as estimated by the Engineer.

- Contractor’s Rights and Actions:

- Variation Instructions: If instructed to execute a Variation exceeding 10% of the Accepted Contract Amount, or if total Variations exceed 30%.

- Payment Delays: Non-receipt of payment as per Sub-Clause 14.7.

- Unnotified Financial Changes: Awareness of material changes in the Employer’s financial arrangements without receiving notice.

- Employer’s Response:

- Evidence of Financial Arrangements: Upon the Contractor’s request, the Employer must provide reasonable evidence within 28 days that they have and will maintain the financial arrangements to pay the remaining Contract Price.

Implications and Applications

- Financial Security for Contractors: This clause provides a safety net for Contractors, ensuring they are informed about the Employer’s financial capacity to meet contract obligations.

- Risk Mitigation: It helps in mitigating financial risks associated with the Employer’s changing financial situation.

- Project Continuity: Ensures project continuity by maintaining financial transparency and stability.

Expert Opinion

- Proactive Monitoring: Contractors should actively monitor for any signs of financial instability in the Employer’s arrangements.

- Documentation and Communication: Maintaining clear records of all financial communications and notices is crucial.

- Legal and Financial Advisory: Contractors may seek legal and financial advice when variations or payment issues arise, especially in complex projects.

Detailed Explanation of Clause 2.4: Employer’s Financial Arrangements

Clause 2.4: Employer’s Financial Arrangements in the FIDIC Yellow Book 2017 outlines the financial responsibilities of the Employer in a construction contract. Here’s a simple breakdown:

- Financial Plans in Contract Data: The Employer must detail their financial plans for the contract in the Contract Data.

- Notifying Changes:

- If the Employer changes their financial arrangements in a way that affects their ability to pay the remaining contract price, they must immediately tell the Contractor, providing detailed information.

- Contractor’s Rights:

- If there’s a big change in the project (like a Variation over 10% of the contract amount), if the Contractor doesn’t get paid on time, or if they find out about a big change in the Employer’s finances that they weren’t told about, they can ask the Employer for proof of financial stability.

- Employer’s Response:

- The Employer must, within 28 days of the request, show they have the financial means to pay what’s left of the contract price.

Comparison with 1999 Version

| Aspect | FIDIC 1999 | FIDIC 2017 |

|---|---|---|

| Request for Evidence | The Contractor can request evidence of financial arrangements at any time. | Specific scenarios are outlined for when the Contractor can request evidence. |

| Notification of Changes | The Employer must notify the Contractor of any material changes to financial arrangements. | Similar, but also includes the impact assessment of the Employer’s ability to pay. |

| Timeframe for Evidence | 28 days after the Contractor’s request. | 28 days after the Contractor’s request, but linked to specific conditions like Variations or non-payment. |

| Scope of Evidence | Evidence related to the ability to pay the entire Contract Price. | Evidence related to the ability to pay the remaining Contract Price. |

Key Differences:

- Trigger for Requesting Evidence: The 2017 version specifies conditions under which the Contractor can request financial evidence, unlike the 1999 version where the request could be made at any time.

- Detailing in Notification: The 2017 version requires detailed particulars when notifying changes, emphasizing the impact on the Employer’s ability to pay.

- Scope of Financial Evidence: The 2017 version focuses on the remaining Contract Price, whereas the 1999 version refers to the entire Contract Price.

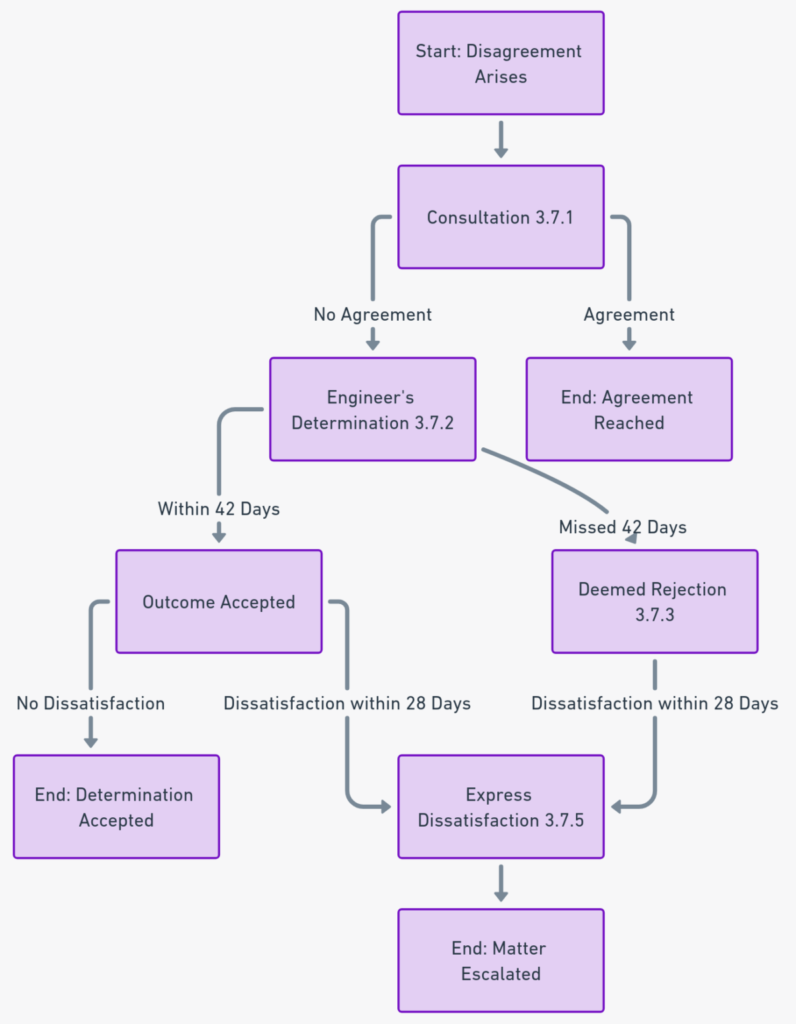

Flowchart

Detailed Explanation of the Color-Coded Flowchart

- Start of Analysis (Pink): The flowchart begins with the analysis of Clause 2.4, focusing on the Employer’s financial arrangements.

- Employer’s Financial Arrangements (Orange): This step involves detailing the Employer’s financial plans in the Contract Data.

- Decision-Making Nodes (Red and Light Blue):

- Material Change in Financial Arrangements (Red): Determines if there’s a significant change in the Employer’s financial situation.

- Contractor’s Rights to Request Evidence (Light Blue): Triggered if certain conditions are met.

- Scenarios Leading to Contractor’s Action (Purple and Dark Blue):

- Variation Exceeds 10% (Purple): If the Contractor faces a Variation order exceeding 10% of the Contract Amount.

- Non-receipt of Payment (Dark Blue): If the Contractor does not receive timely payments.

- Unnotified Financial Change (Dark Purple): If the Contractor discovers a significant financial change that wasn’t notified.

- Employer’s Response (Grey):

- Providing Financial Evidence: The Employer must, within 28 days, show evidence of their financial capability to pay the remaining Contract Price.

- End Goal (Pink): Ensuring financial transparency and security in the contract, protecting both parties’ interests.