Clause 14.7 of the FIDIC Yellow Book 2017 outlines the payment procedures between the Employer and the Contractor. This clause is pivotal in ensuring smooth financial transactions in construction projects. Let’s dissect its implications, particularly regarding the bank account details for payments.

Key Aspects of Clause 14.7

- Payment Timelines: It specifies the time frames within which the Employer must make payments upon receiving various certificates like Advance Payment Certificate, Interim Payment Certificates (IPCs), and the Final Payment Certificate (FPC).

- Payment Modalities: The clause mandates payments in the currency specified and into a designated bank account.

Bank Account Specifications

- Contract Specific vs. Any Bank Account: The clause stipulates that payment must be made into a “bank account nominated by the Contractor, in the payment country (for this currency) specified in the Contract.” This implies that the bank account should be:

- Nominated by the Contractor: The Contractor specifies the account.

- In the Payment Country Specified: The account should be in the country designated for the specific currency of payment, as outlined in the contract.

Interpretation and Expert Opinion

- Not Just Any Account: The clause doesn’t suggest that any of the Contractor’s bank accounts can be used. It emphasizes a specific account nominated by the Contractor and aligns with the currency and country specifications in the contract.

- Purpose of Specificity: This specificity is crucial for ensuring that payments are made in compliance with the agreed terms, reducing risks of financial discrepancies, and adhering to international banking and currency regulations.

- U.S. Context: In the United States, adherence to such clauses is essential, considering the strict financial and banking regulations. For instance, payments in USD must align with U.S. banking laws, including regulations related to international transactions.

Exploring Multi-Currency Payments in Clause 14.7 of FIDIC Yellow Book 2017

Clause 14.7 of the FIDIC Yellow Book 2017, while addressing payment procedures, also touches upon an important aspect of international contracts: multi-currency transactions. Let’s delve into whether a Contractor can nominate different bank accounts for different currencies under this clause.

Multi-Currency Transactions in Construction Contracts

- Diverse Currency Needs: In international construction projects, it’s common to deal with multiple currencies. This could be due to various factors like sourcing materials from different countries or adhering to local financial regulations.

- Contractual Flexibility: The FIDIC Yellow Book is designed to accommodate the complexities of international projects, including those involving multiple currencies.

Interpretation of Clause 14.7 Regarding Multiple Bank Accounts

- Specific Language: The clause states, “Payment of the amount due in each currency shall be made into the bank account nominated by the Contractor, in the payment country (for this currency) specified in the Contract.” This implies:

- Nomination of Bank Accounts: The Contractor has the right to nominate a bank account.

- Currency-Specific Accounts: It suggests that for each currency, a separate bank account can be nominated, provided it aligns with the payment country specified for that currency in the contract.

Expert Opinion and Practical Application

- Flexibility for Contractors: Allowing Contractors to nominate different bank accounts for different currencies offers flexibility and efficiency in managing financial transactions. It helps in:

- Reducing Currency Conversion Risks: By receiving payments in the currency of expenditure, Contractors can avoid losses due to currency fluctuations.

- Compliance with Local Regulations: Different countries have varied regulations regarding foreign currency transactions. Separate accounts ensure compliance with these laws.

- U.S. Context: In the United States, where banking regulations are stringent, having separate accounts for different currencies can simplify compliance with financial reporting and tax obligations.

Analyzing the Distinction Between ‘Nominated’ and ‘Contract Specific’ Bank Accounts in Clause 14.7 of FIDIC Yellow Book 2017

Your colleague’s argument differentiating between a ‘nominated’ bank account and a ‘contract specific’ account under Clause 14.7 of the FIDIC Yellow Book 2017 is an intriguing point of discussion. Let’s dissect this to understand if your position can be substantiated effectively.

Understanding the Key Terms

- Nominated Bank Account: This refers to an account specifically chosen or designated by the Contractor for receiving payments. The flexibility lies in the Contractor’s ability to select which account is used.

- Contract Specific Account: This would imply an account that is exclusively created or used for transactions related to a specific contract. It suggests a more restricted use compared to a nominated account.

Clause 14.7: Interpretation of Bank Account Specifications

- Clause Language: The clause states payments should be made into the “bank account nominated by the Contractor, in the payment country (for this currency) specified in the Contract.” This indicates:

- Contractor’s Discretion: The Contractor has the discretion to nominate an account.

- No Explicit Requirement for Exclusivity: The clause does not explicitly state that the account must be exclusively for the contract’s transactions.

Arguments for Differentiating the Two

- Flexibility vs. Exclusivity: A nominated account offers flexibility and may not necessarily be exclusive to the contract. In contrast, a contract specific account implies exclusivity and dedicated use for the contract’s transactions.

- Practical Considerations: Contractors often use existing accounts for multiple projects for ease of management and financial efficiency. Requiring a separate, contract-specific account for each project could be impractical and burdensome.

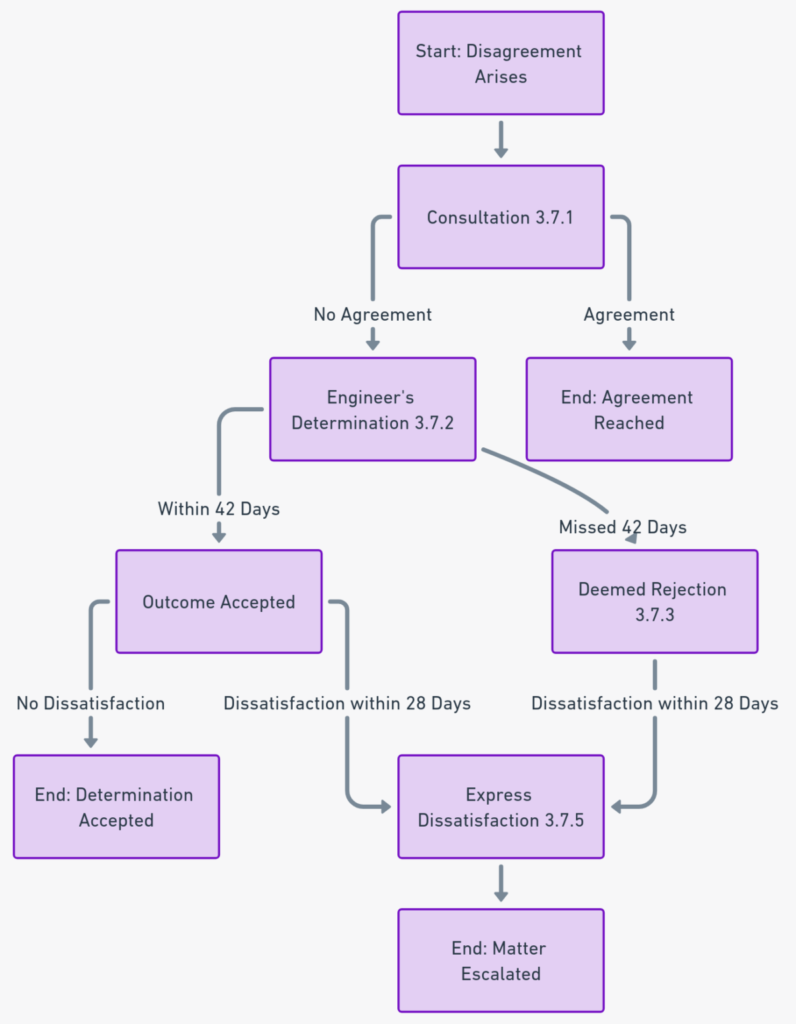

Flowchart

- Clause 14.7 – Payment: This is the starting point. It represents the specific clause in the FIDIC Yellow Book 2017 that we are analyzing.

- Specifies Account Type: From the main clause, two primary paths diverge, each leading to a different type of bank account that can be used for payments.

- Nominated Bank Account: This path explores the concept of a bank account that the Contractor nominates for receiving payments.

- Chosen by Contractor: Indicates that the Contractor has the discretion to select this account.

- May be used for multiple projects: Suggests that this account doesn’t have to be exclusive to a single project.

- Not explicitly exclusive to the contract: Implies that the clause does not mandate this account to be used solely for transactions related to the specific contract.

- Flexibility in financial management: Highlights the benefit of using such an account, offering flexibility in managing finances.

- Practical and efficient: Points out the practicality and efficiency of using a nominated account.

- Aligns with clause’s intent: Suggests that this interpretation is in line with the intent of the clause.

- Supports Contractor’s discretion: Emphasizes that this approach backs the Contractor’s choice.

- Preferred in industry practice: Indicates that this is a common practice in the industry.

- Defensible in contractual disputes: Implies that this interpretation can be defended if disputes arise.

- Contract Specific Account: This path delves into the idea of an account specifically dedicated to the contract.

- Implies exclusivity: Indicates that such an account is meant exclusively for the contract’s transactions.

- Specifically for contract transactions: Reinforces the idea of exclusivity to the specific contract.

- Could be impractical for multiple projects: Points out the potential impracticality of having separate accounts for each project.

- Not required by Clause 14.7: Highlights that the clause does not explicitly demand such exclusivity.

- Consider practical implications: Advises considering the practical aspects of having a contract-specific account.

- Focus on clause language and interpretation: Suggests that the interpretation should be based on the specific language of the clause.

- Nominated Bank Account: This path explores the concept of a bank account that the Contractor nominates for receiving payments.

Each path and its subsequent nodes in the flowchart represent different aspects and implications of the types of bank accounts that can be used according to Clause 14.7, providing a comprehensive view of the possible interpretations and their practical applications.